美股SPAC費用

1. SPAC介紹

SPAC,特殊目的收購公司,也被成為「空白支票公司」,是美股市場一種特殊的上市方式。

發起人建立SPAC空殼先行上市,目的是從投資者處募集資金以在限定時間(一般為24個月)內並購一家標的公司,使其快速成為美國上市公司。

SPAC是一個只有現金,沒有實際業務的新「空殼公司」,僅作為上市平台。目標公司與SPAC合併即可實現上市,並獲得SPAC的資金。

2. SPAC費用

根據SPAC整個運行週期,設立五大類收費項

| 收費項 | 收費標準 | 備註 |

|

拆分持倉unit (公司行動) |

免費 | —— |

|

拆分持倉unit (自主申請) |

400 USD/筆 | —— |

|

贖回持倉unit (自主申請) |

200 USD/筆 | 1. 贖回日期通常是會議日期的2天前,請不遲於贖回日期前2天中午十二點前提交。 例如7月5日為贖回日,請在7月3日中午12點前提交。 2. 贖回款項通常會在1 - 3周內支付到帳戶。 |

|

合併後換股 (公司行動) |

免費 | —— |

|

行使認購權證 (自主申請) |

免費 | 1. 需同意行使相關條例,並說明是以現金還是非現金方式(若適用)行使權益。 2. 認購權證必須交割才能提交行權,持有人必須確保他們的帳戶有適當的資金,行權價格將在處理時從帳戶中扣除。 |

公司行動:非客戶自主申請行為,SPAC公司批量行為

*若涉及到清算系統遷移,費用可能有變化

3. 如何申請

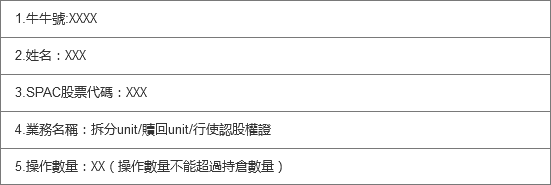

若客戶需執行自主申請類操作,請提供以下資料,發送至cs@futuhk.com進行申請: