美國存托憑證 (ADR) 代收費用

1. ADR介紹

ADR,美國存托憑證 (ADRs, American Depository Receipts) 是指由美國存托銀行發行的代表特定數量股份的可轉讓憑證,通常是非美國公司的股票,使投資者可在美股市場上交易。

2. ADR費用

ADR除了會定期收取ADR托管費以外,部分ADR還會收取股息費用、比例變更費用等等。因各個ADR情況有所不同,具體費用資訊請參閱各ADR的招股說明書或通過 SEC EDGAR 企業搜尋工具查詢。

|

費用類型 |

費用說明 |

收取金額 |

收取次數 |

|

托管費用 |

ADR發行機構會向券商或者結算公司收取託管費用,券商再向持有ADR的投資者收取

|

平均每股$0.02至$0.05 |

不定,每年可能多次收取 |

|

股息派發/拆合股費用 |

ADR分紅時可能產生股息費或者因拆合股而產生相關費用 |

具體金額不定 |

隨發生次數收取 |

|

取消發行費用 |

ADR退市或取消發行,有可能產生相關費用 |

平均每股$0.02至$0.05 |

隨發生次數收取 |

|

比例變更費用 |

ADR與正股比例發生變更,存托行會因比例變更而收取相關費用 |

平均每股$0.02至$0.05 |

隨發生次數收取 |

請留意:以上費用僅供參考,具體收取的金額、頻率和時間會因不同的ADR而有所不同。

3. 如何收取ADR費用

一般來說, ADR的費用收取方式為在收取日當天扣除對應的現金。當ADR費用產生時,托管行會定時更新這些規則日期,如登記日,收取日等。券商會在登記日提前凍結應收金額,再根據存托行實際收取日扣除。

登記日:在登記日持有ADR已交收持倉,即登記日T-2交易日收盤時持有則會被收取費用。如在登記日及之後賣出仍會收取費用。

收取日:銀行實際扣款日,由於資金交收等原因,券商扣款日可能與銀行收取日有所不同。

請留意:ADR的費用在凍結或扣除時,將有系統消息及郵件通知。

4. ADR費用查詢

一般市場上的大部分ADR托管在四家存托行,即紐約梅隆銀行,德意誌銀行,花旗銀行以及摩根大通銀行。

部分ADR為單一銀行獨家托管,若一家銀行無法找到相關信息,請嘗試搜尋另外三家銀行。

4.1 紐約梅隆銀行

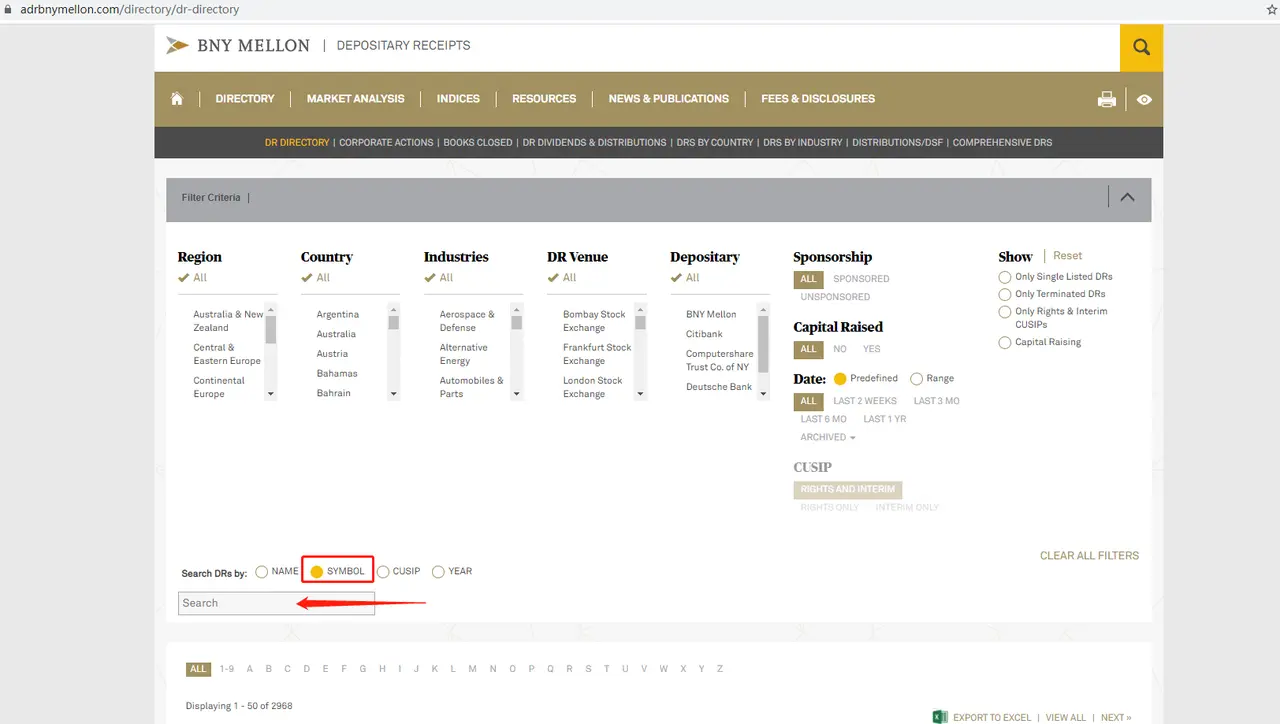

登陸 紐約梅隆銀行 後選擇 'Symbol',輸入股票代碼,即會彈出相關ADR詳情界面。

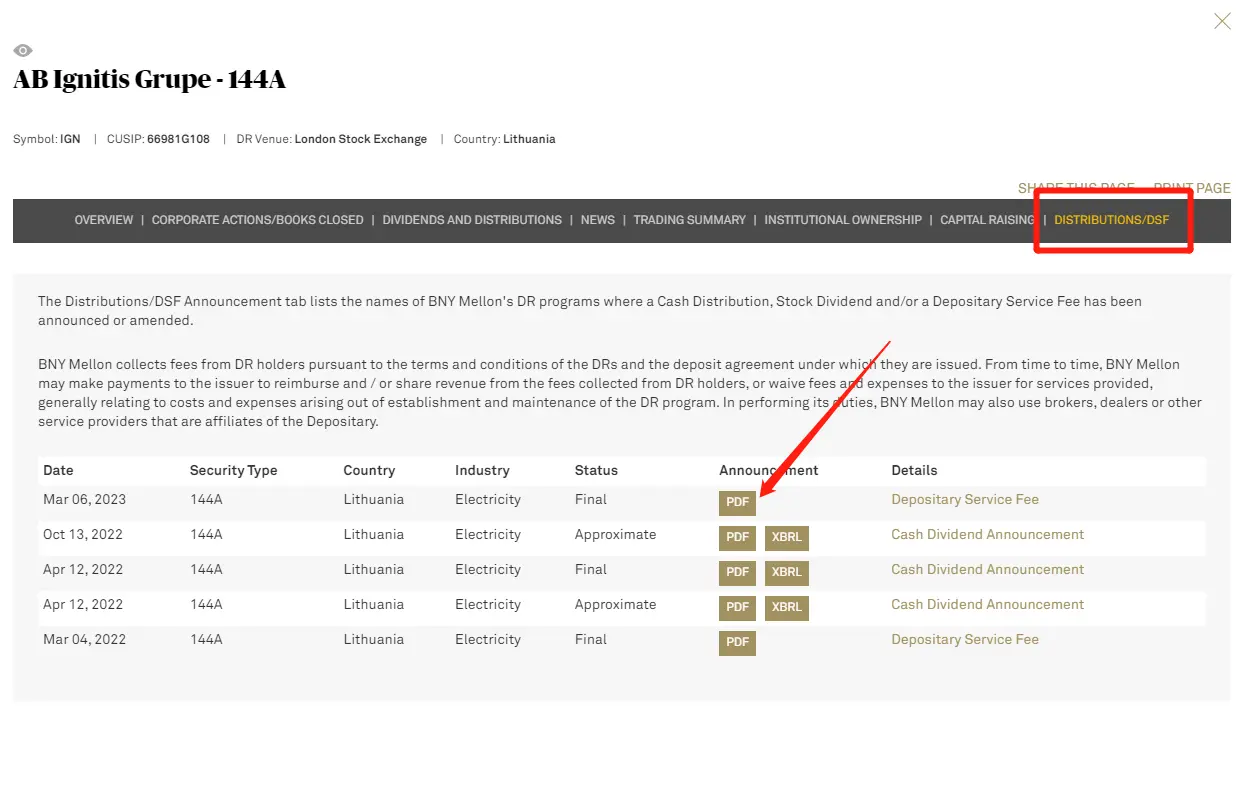

在 ADR 詳情頁面點擊 'Distribution/DSF',即可查看ADR收費詳情,點擊 'PDF' 可查看或下載銀行原文通告。

4.2 德意誌銀行

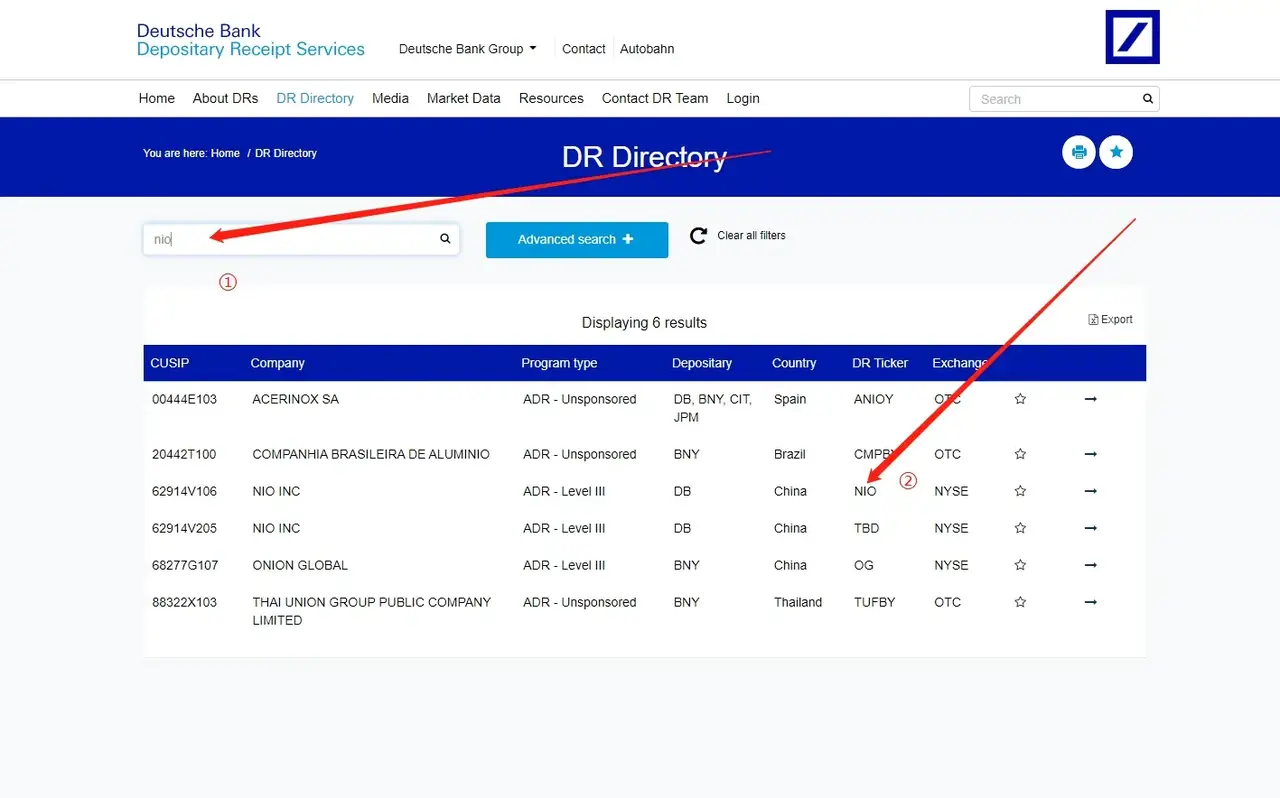

登陸 德意誌銀行 後在搜尋欄內輸入股票代碼,點擊對應 'DR Ticker' 後出現ADR詳情頁面。

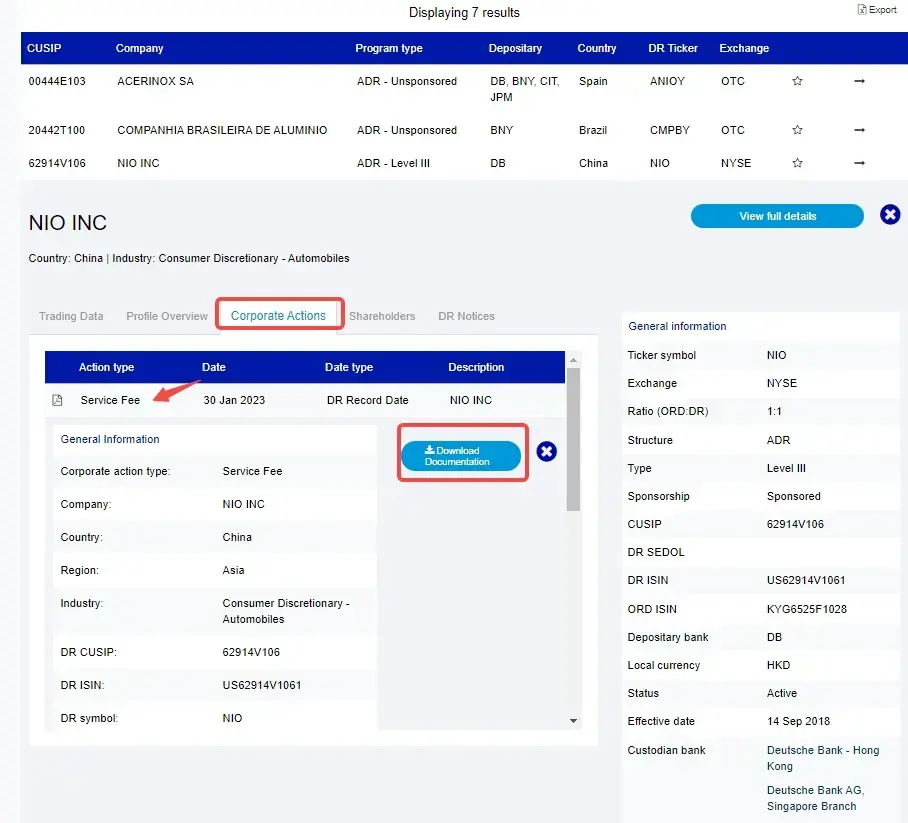

在彈出的詳情頁點擊 'Corporate Actions',即可查看ADR收費詳情,也可點擊右側鏈接下載銀行原文通告。

4.3 花旗銀行

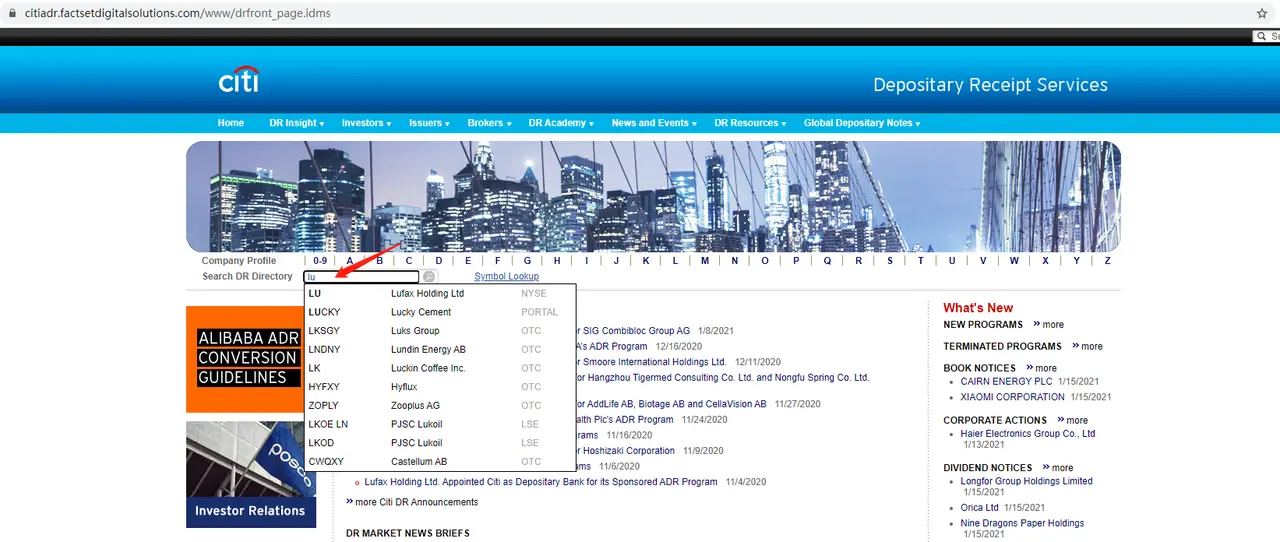

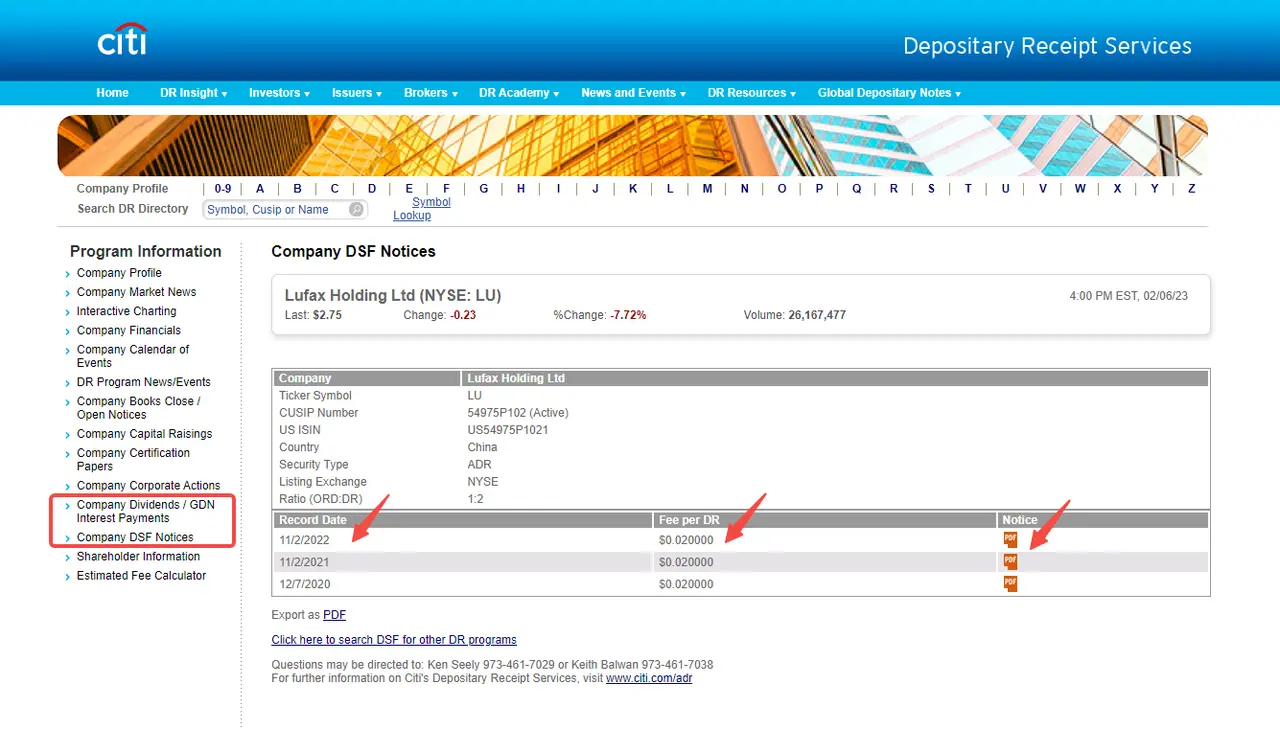

登陸 花旗銀行 後在搜尋欄內輸入股票代碼,點擊搜尋後會彈出ADR詳情頁面。

在彈出的詳情頁右側導航欄點擊 'Company Dividends/GDN Interest Payments'/ 'Company DSF Notices',即可查看ADR收費詳情,也可通過點擊PDF標誌下載銀行原文通告。

4.4 摩根大通銀行

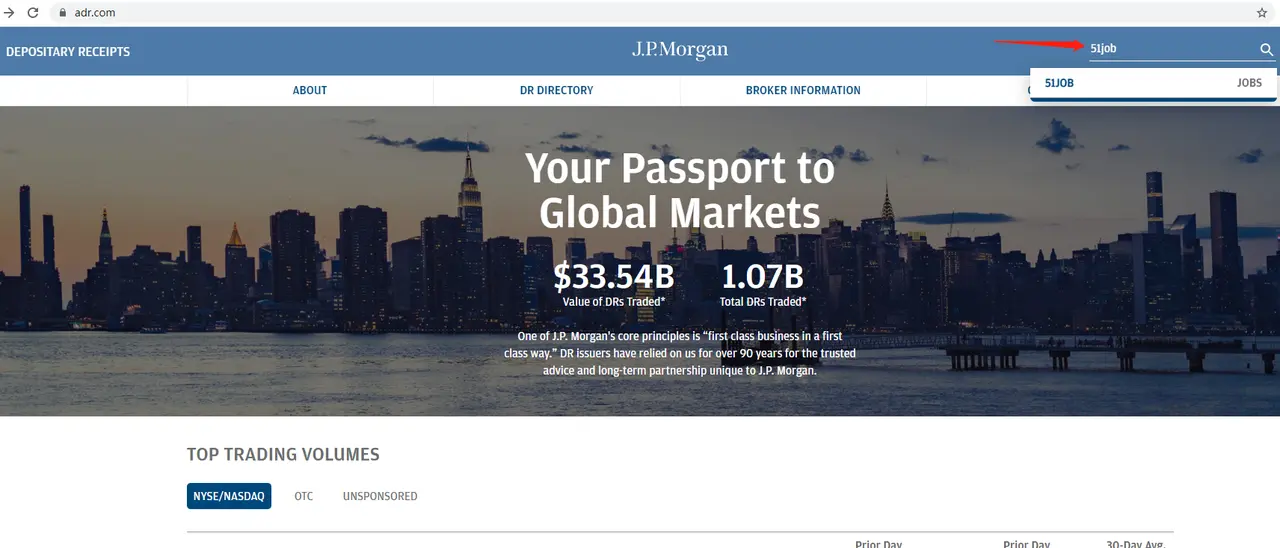

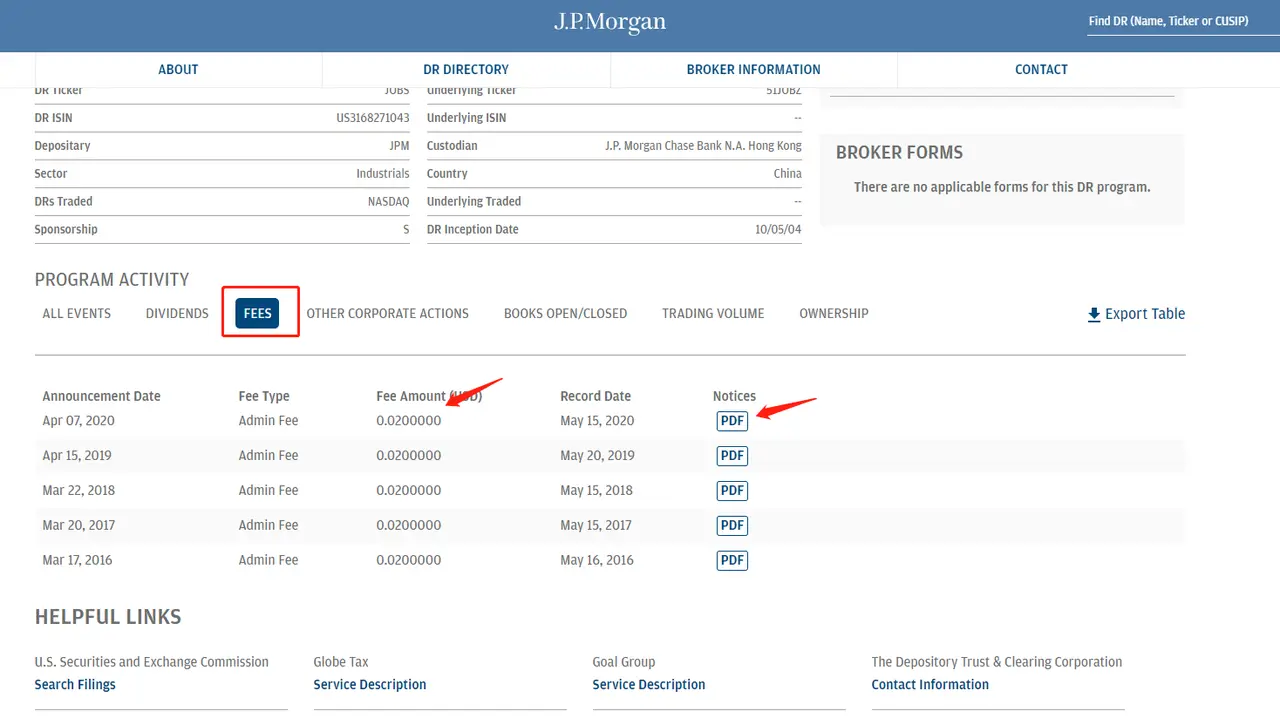

登陸 摩根大通銀行 後在搜尋欄內輸入股票代碼,點擊搜尋後會彈出ADR詳情頁面。

在彈出的詳情頁下方 'Program Activity' 點擊 'Fees',即可查看ADR收費詳情,也可通過點擊PDF標誌下載銀行原文通告。

5. ADR扣費明細

在日結單中,請留意備注裡面的ADR費用描述,也可以通過「APP - 帳戶 - 任意帳戶卡片 - 更多 - 資金明細」查看扣費明細。